Chapter 2: Dollar Hegemony Mechanics

"Control of the world's reserve currency is the monetary equivalent of having the world's largest navy in the 19th century."

— Anonymous central banker

Overview

Chapter 1 traced the historical evolution of monetary systems. This chapter examines how dollar hegemony operates in practice: the infrastructure, the institutions, the decision-makers, and the choke points.

Understanding these mechanics serves two purposes. First, it reveals why alternatives have failed: the system's architecture creates powerful lock-in effects. Second, it exposes vulnerabilities: any alternative must either work within these structures or route around them.

Chapter Structure:

- The Financial Plumbing — SWIFT, correspondent banking, payment systems

- The Petrodollar Architecture — Oil markets and dollar demand

- IMF/World Bank Conditionality — Enforcement through lending

- The Sanctions Toolkit — Case study: Russia 2022

- Vulnerabilities — Cracks in the edifice

2.1 The Financial Plumbing

International dollar transactions flow through a specific infrastructure. Control of this infrastructure confers the ability to observe, delay, or block transactions.

SWIFT: The Messaging Layer

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a messaging system, not a payment system. It transmits standardized messages between financial institutions: "Bank A wants to send $X to Bank B."

Key Facts:

- Headquartered in Belgium (nominally outside US jurisdiction)

- Connects 11,000+ financial institutions in 200+ countries

- Processes approximately 42 million messages daily

- Does not actually move money—only information about money

Governance:

- Owned by member financial institutions

- Board includes representatives from major economies

- US, EU, and others have seats

- EU regulations apply (Belgian incorporation)

US Influence:

Despite Belgian incorporation, the US exercises significant influence:

- SWIFT Board membership: US banks are major shareholders

- Bilateral agreements: Post-9/11 Terrorist Finance Tracking Program gave US Treasury access to SWIFT data

- Sanction compliance: SWIFT must comply with US/EU sanctions to maintain access to dollar markets

- Correspondent banking pressure: Banks fear losing US correspondent relationships

Correspondent Banking: The Actual Money Movement

SWIFT messages trigger transactions. The transactions themselves occur through correspondent banking—a network where large banks hold accounts with each other.

How it works:

- Indonesian bank wants to send dollars to Brazilian bank

- Neither has direct relationship with the other

- Both have accounts at a US correspondent bank (e.g., JPMorgan)

- Transaction settles by adjusting balances at JPMorgan

US Position:

- Most international dollar transactions clear through US correspondent banks

- Major US banks (JPMorgan, Citi, Bank of America) are hubs

- US regulators have jurisdiction over these transactions

- Even transactions between two non-US entities often touch US banks

Fedwire and CHIPS: Wholesale Settlement

Final settlement of large dollar transactions occurs through:

Fedwire: - Operated by the Federal Reserve - Real-time gross settlement (each transaction settles individually) - ~$4 trillion daily volume - Fully within US regulatory jurisdiction

CHIPS (Clearing House Interbank Payments System): - Private system owned by major banks - Net settlement (batches transactions) - ~$1.8 trillion daily volume - Also within US jurisdiction

Implication: Any significant dollar transaction, anywhere in the world, ultimately touches US infrastructure and falls under US legal jurisdiction.

Choke Point Map

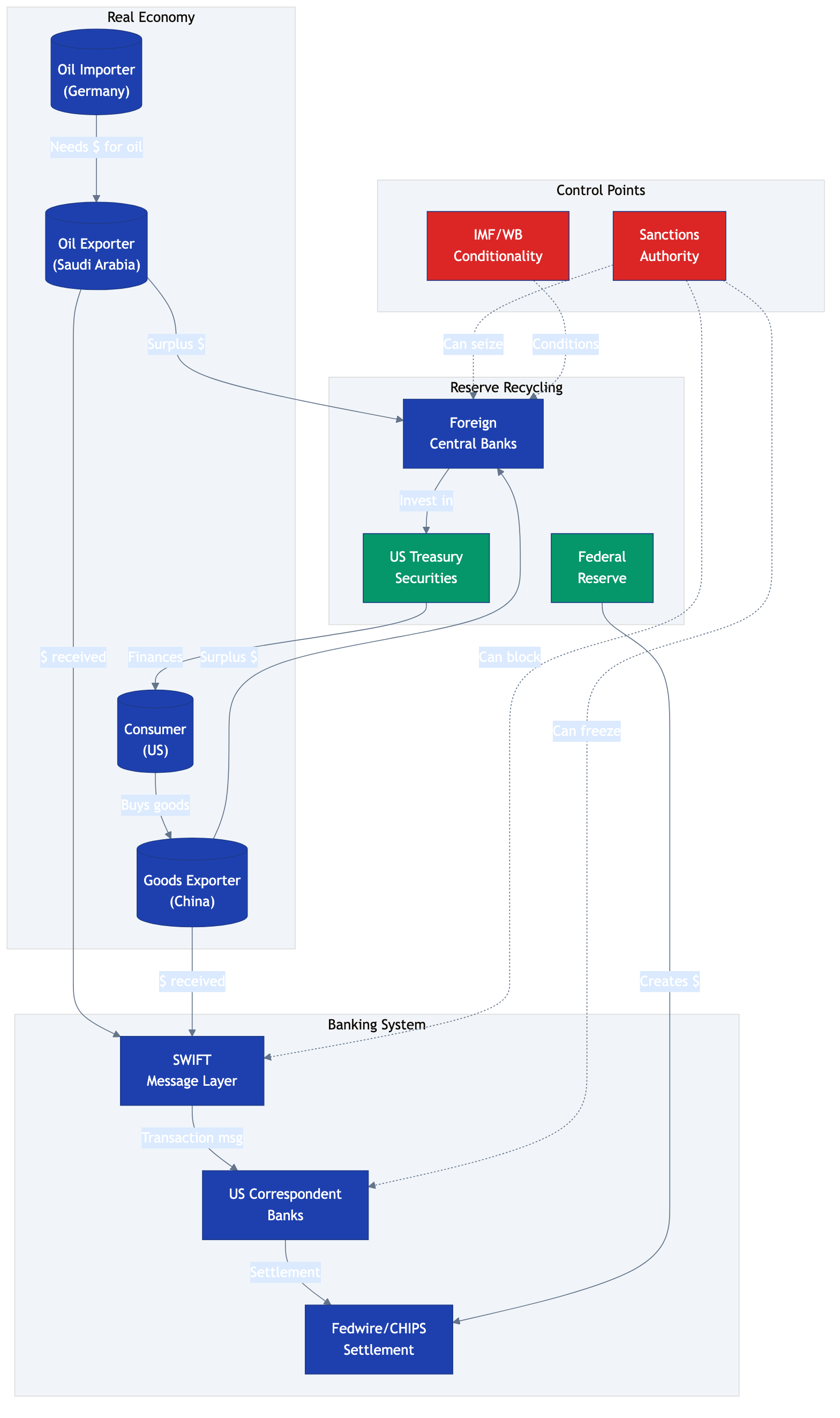

Figure 2.1: Dollar circulation and control points. Red nodes indicate US control over transaction flow.

Figure 2.1: Dollar circulation and control points. Red nodes indicate US control over transaction flow.

At each stage, the US can observe, delay, or block. This is not a conspiracy—it's simply how the infrastructure developed, with the US at the center.

2.2 The Petrodollar Architecture

The 1974 Saudi-US arrangement created structural demand for dollars beyond trade patterns.

Historical Origins

Following the 1973 oil crisis and the end of dollar-gold convertibility, the US needed a new source of dollar demand. Treasury Secretary William Simon negotiated an arrangement with Saudi Arabia:

Saudi Commitments: 1. Price oil exclusively in dollars 2. Invest surplus petrodollars in US Treasury securities 3. Use oil revenues to purchase US goods and services

US Commitments: 1. Provide military equipment and training 2. Guarantee Saudi security 3. Support the Saudi regime

Mechanism

The arrangement creates a recycling loop:

- Oil importer needs dollars to buy oil

- Saudi Arabia receives dollars, invests in Treasuries

- US Treasury can finance deficits cheaply

- US consumers can buy imported goods

- Loop continues...

Other OPEC members followed Saudi Arabia's lead. By 1975, OPEC as a whole priced oil in dollars.

Scale

- Global oil trade: ~100 million barrels/day

- At \(80/barrel: ~\)8 billion/day in dollar-denominated transactions

- Annual oil trade: ~$2.9 trillion

This creates persistent, structural demand for dollars beyond what trade patterns alone would generate.

Evolution and Challenges

The petrodollar arrangement faces contemporary pressures:

- China: Buying increasing amounts of oil in yuan

- Russia: Pricing some energy exports in rubles (post-2022)

- Saudi-China relations: Discussions of yuan-denominated oil sales

- Renewable transition: Long-term reduction in oil demand

Despite these challenges, dollar dominance in oil markets remains substantial. Change is measured in years, not months.

2.3 IMF/World Bank Conditionality

The Bretton Woods institutions—International Monetary Fund and World Bank—function as components of the dollar system.

IMF Lending and Conditionality

When countries face balance-of-payments crises, the IMF provides emergency lending. This lending comes with conditions—policy reforms the country must implement.

Typical Conditionality:

- Fiscal austerity (reduce government spending)

- Monetary tightening (raise interest rates)

- Trade liberalization (reduce tariffs)

- Privatization of state enterprises

- Capital account liberalization (allow foreign investment)

Observed Pattern:

Conditions typically favor foreign (often US) creditors over domestic populations:

- Austerity reduces domestic demand

- High interest rates attract foreign capital but constrain local business

- Trade liberalization benefits competitive exporters (often developed nations)

- Privatization often results in foreign acquisition of strategic assets

- Capital liberalization increases vulnerability to sudden outflows

World Bank and Development Finance

The World Bank provides longer-term development lending. Project conditions often include:

- Procurement rules that favor developed-country contractors

- Policy reforms aligned with "Washington Consensus" prescriptions

- Environmental and social standards that, while sometimes beneficial, impose costs

Voting Structure

Both institutions have weighted voting:

IMF: - US: 16.5% of votes (effective veto on major decisions, which require 85%) - EU (combined): ~30% - China: 6.4% - Entire African continent: ~5%

World Bank: - Similar structure - US has effective veto over major changes

Implication: The institutions that provide crisis lending and development finance are controlled by the same nations that benefit from dollar hegemony.

Function in the System

IMF/World Bank conditionality serves several functions:

- Crisis response: Provides genuine liquidity during emergencies

- Policy alignment: Ensures recipient countries adopt dollar-friendly policies

- Creditor protection: Prioritizes repayment to foreign creditors

- System maintenance: Prevents alternative arrangements from developing

This is not necessarily a conspiracy. Many IMF/World Bank staff believe their prescriptions are genuinely beneficial. But the structural effect is to reinforce dollar-centered finance.

2.4 The Sanctions Toolkit: Russia 2022

The response to Russia's invasion of Ukraine in February 2022 demonstrated the full range of dollar-based coercive tools.

Timeline of Escalation

Pre-invasion (2014-2022): - Sectoral sanctions following Crimea annexation - Limited financial restrictions - Some oligarch asset freezes

February 24, 2022 (invasion): - Immediate announcement of expanded sanctions

February 26, 2022: - SWIFT disconnection announced for selected Russian banks - Central Bank of Russia assets frozen

Subsequent weeks: - Additional banks added to SWIFT exclusion - Oligarch asset seizures expanded - Secondary sanctions threatened against sanctions evaders - Russian sovereign assets (~$300B) immobilized

Tools Deployed

1. SWIFT Disconnection

Selected Russian banks removed from SWIFT messaging system. Effect: those banks cannot communicate with international counterparts using standard protocols.

Partial exclusion (some banks remained connected) was deliberate—Europe still needed to pay for Russian gas.

2. Central Bank Asset Freeze

Approximately $300 billion in Russian central bank reserves held in Western jurisdictions were frozen. The Central Bank of Russia could no longer access these reserves for currency intervention or import payments.

This was unprecedented. Central bank reserves were previously considered sacrosanct—the whole point of reserves is availability during crisis.

3. Correspondent Banking Severance

US banks instructed not to process transactions with designated Russian entities. Even without SWIFT disconnection, this blocks dollar access.

4. Oligarch Asset Seizure

Personal assets (yachts, real estate, accounts) of designated Russian oligarchs seized in Western jurisdictions.

5. Secondary Sanctions Threat

Non-Russian entities warned that dealing with sanctioned Russian entities could result in being cut off from US financial system. This extends US jurisdiction globally.

Observed Effects

On Russia: - Initial ruble collapse (recovered partially) - Inflation spike - Reduced import access - Technology procurement difficulties - Financial system stress

On Global System: - Demonstrated willingness to weaponize reserves - Accelerated de-dollarization discussions - China, India, others took note - Central banks began diversifying reserve holdings

Lessons

- Capability is vast: The US/EU can effectively exclude a major economy from much of global finance

- Costs exist: Sanctions also hurt sanctioners (inflation, disrupted supply chains)

- Partial effectiveness: Russia continued operating, found workarounds

- Precedent effect: Other countries now know their reserves can be seized

The Russia case revealed both the power and the limits of financial coercion.

2.5 Vulnerabilities

Dollar hegemony appears overwhelming, but every system has weaknesses.

Technical Vulnerabilities

SWIFT Alternatives: - China's CIPS (Cross-Border Interbank Payment System) - Russia's SPFS (System for Transfer of Financial Messages) - Neither yet rivals SWIFT scale, but both growing

Bilateral Arrangements: - India-Russia rupee-ruble trade - China-Saudi yuan oil discussions - Brazil-China yuan-denominated trade

Cryptocurrency: - Bitcoin and stablecoins enable transactions outside traditional infrastructure - Currently small scale but technically capable - Regulatory crackdown possible but difficult globally

Institutional Vulnerabilities

BRICS Development Bank: - Alternative to IMF/World Bank - Currently small but growing - Does not impose "Washington Consensus" conditions

Regional Arrangements: - Asian Infrastructure Investment Bank (China-led) - Chiang Mai Initiative (Asian currency swap) - African Union financial integration efforts

Legitimacy Vulnerabilities

Weaponization Backlash: - Russia 2022 showed what US can do - Other countries now hedge against similar treatment - "What if we're next?" logic

Share Decline: - Dollar share of reserves: 85% (1970s) → 59% (2024) - Slow decline, but directionally clear

Demographic Shift: - US share of global GDP declining - BRICS GDP now exceeds G7 in PPP terms - Economic weight shifting toward non-dollar users

Structural Constraints

Despite vulnerabilities, replacement remains difficult:

- No alternative offers dollar's liquidity

- Network effects favor incumbent

- US still largest single economy

- US military backs security of dollar holdings

- Alternatives have their own trust issues (would you rather hold yuan under CCP?)

Assessment

Dollar hegemony is not eternal, but replacement is measured in decades, not years. The system's vulnerabilities are real but not immediately fatal.

2.6 Key Takeaways

-

Infrastructure matters: Control of SWIFT, correspondent banking, and settlement systems gives the US visibility and veto over international dollar transactions.

-

Petrodollar creates structural demand: The 1974 arrangement and its successors ensure persistent dollar demand beyond trade patterns.

-

IMF/World Bank reinforce: Conditionality ensures crisis countries adopt dollar-friendly policies. Voting weights give US effective veto.

-

Sanctions demonstrate power: Russia 2022 showed the full toolkit—SWIFT, reserves, correspondent banking, secondary sanctions.

-

Vulnerabilities exist: Alternatives are developing, legitimacy is questioned, share is declining. But replacement remains distant.

Further Reading

- Eichengreen, B. (2011). Exorbitant Privilege

- Spiro, D. (1999). The Hidden Hand of American Hegemony: Petrodollar Recycling and International Markets

- Farrell, H. & Newman, A. (2019). "Weaponized Interdependence"

- Stiglitz, J. (2002). Globalization and Its Discontents (on IMF conditionality)

- US Treasury. (2022). "Russia Sanctions Implementation" (primary documents)